Introduction:

Sedulo Group recently analyzed clinical trials for unapproved primary immuno-oncology (IO) drugs. Our analysis of global data gathered from multiple trial registries provided a compelling snapshot of the recent IO clinical landscape and prompted several unanswered questions regarding future evolution and the impact on manufacturers competing in the space.

Our Approach to this Analysis:

We started by analyzing pharma-sponsored clinical trials,1 initiated between 2018 and 2022, for only unapproved primary immuno-oncology (IO) drugs. Our initial analysis disclosed some emerging trends in IO modalities and trial locations.2

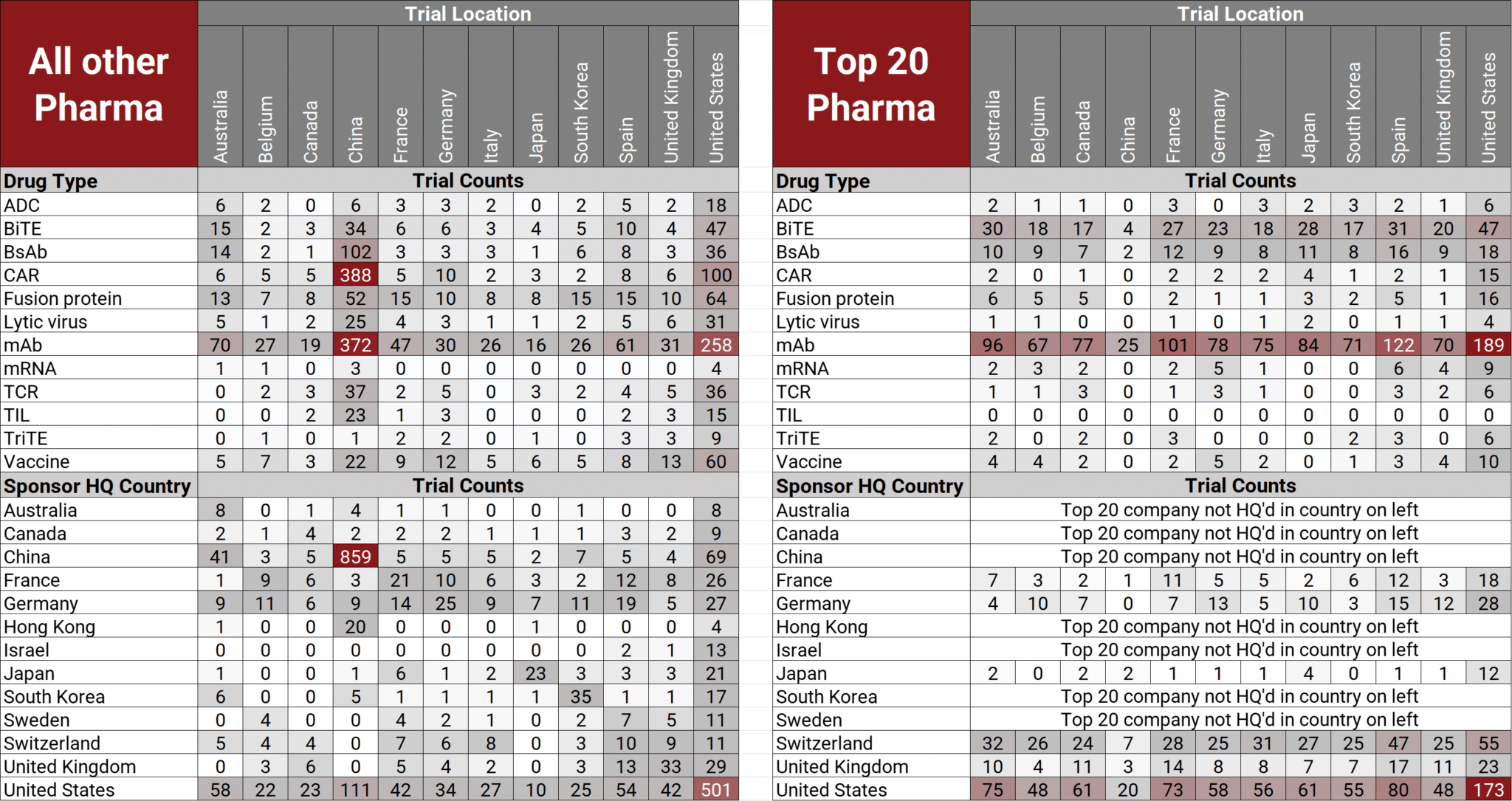

Next, we grouped pharmaceutical sponsors/collaborators by their Scrip 100 industry rankings into two groups: top 20 pharma and all other pharma.3 We noticed striking differences in trial locations, especially for China and the United States, which led to an analysis of different trial metrics within the top ten countries for each group. Countries in common included Australia, France, Germany, Italy, South Korea, Spain, the United Kingdom, and the United States, while countries not shared were Belgium, Canada, China, and Japan.

The heatmap below provides a visual distribution of drug types and sponsor HQ location for recent IO trials conducted by these two pharma groups.

Sources:

- Trialtrove ǀ Citeline, February 2023

- Start dates and trial locations were identified via publicly disclosed information.

- Scrip 100 Top 20 sponsors were updated in January 2023 per Pharmaprojects. Rankings are based on fiscal 2021 drug sales.

Notes:

- Abbreviations: ADC = Antibody Drug Conjugate, BiTE = Bispecific T-cell Engager, BsAb = bispecific antibody, CAR = Chimeric Antigen Receptor, HQ = headquarters mAb = monoclonal antibody, TCR = T-cell Receptor, TIL = Tumor Infiltrating Lymphocyte, TriTE = Trispecific T-cell Engager

- Trial locations and primary drug modalities are not mutually exclusive. Primary drugs could be assigned more than one drug modality, as defined by Pharmaprojects. Trials could be conducted in more than one location.

Key Takeaways from the Assessment:

While several insights were uncovered by analyzing trial clusters and the different IO drug modalities and sponsors, a few key takeaways from the data included:

- China emerging as innovation hub for IO therapies

- Smaller pharma/biotech conducting trials for emerging IO technologies

- Chinese and US small pharma/biotech initiating the vast majority of recent IO trials

Where does this lead us?

This assessment led to several unanswered questions regarding the evolution of the clinical landscape, including:

- Why are the top 20 pharma companies still entrenched in conducting recent IO trials primarily with the established technology of mAb, while all other pharma companies conducting recent IO trials with emerging technologies such as BsAb, CAR-NK/CAR-T, fusion proteins or vaccines?

- Why did Chinese pharma companies conduct an overwhelming majority of their trials in China, whereas United States pharma companies conduct their trials spread across all listed countries?

- How will Chinese companies position their drugs in ROW given the FDA’s reluctance to approve drugs based on clinical data generated outside of the US?

- How will the proliferation of IO trial activity in China impact top 20 Pharma M&A activity?

How Sedulo Can Help:

Understanding the choices your competitors have made about their clinical program will assist you in making better-informed decisions about your clinical strategy. As leaders in competitive strategy consulting, serving the life sciences community for the last 17 years, Sedulo Group can help you:

- Build a comprehensive view of the current and future competitive landscape.

- Obtain details on competitor clinical trial locations.

- Assess and benchmark enrollment timing.

- Monitor key activity within the landscape.

- Pressure test your strategy through scenario planning workshops.

By leveraging our proprietary approach to research and insight development, our skilled team of competitive strategy professionals follows a systematic “Four I’s” process to gather Information, analyze Intelligence, uncover Insights, and contextualize Implications.

This process ensures our clients have a holistic view of the competitive landscape and enables them to anticipate and understand future competitor and market developments.