The pharmaceutical industry is being reshaped by a wave of structural, technological, and geopolitical disruptions. From pricing reform to pipeline productivity concerns, pharma competitive intelligence and strategy leaders are being asked to do more than just track trends in the pharmaceutical industry, they must help their organizations navigate through them.

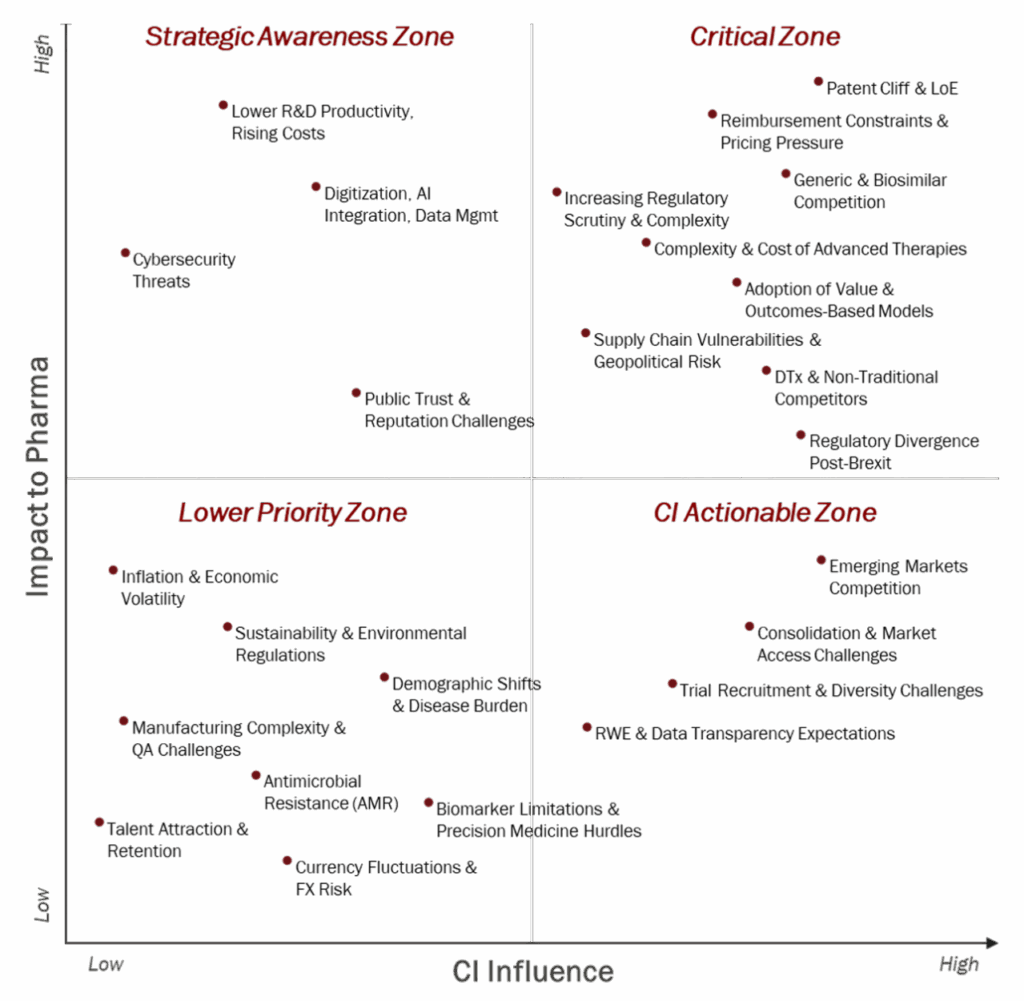

At Sedulo, we analyzed 25 of the most pressing pharmaceutical market trends and headwinds facing the sector and asked two core questions:

- How much strategic impact does this market trend or headwind have on the organization?

- To what degree can CI teams help organizations navigate these market trends and headwinds?

What emerged was a CI Prioritization Framework, a tool designed to help teams focus their resources where they can deliver the most value.

Categorizing & Prioritizing Pharma Market Trends and Headwinds Shaping the Future

The trends and headwinds analyzed fell into six broad domains:

- Regulatory & Policy Challenges: Stricter global regulations, pricing reforms, and post-Brexit compliance burdens.

- Market & Competitive Challenges: Generics, biosimilars, and emerging markets drive competition, while value-based models reshape access.

- Innovation & R&D Challenges: R&D costs are rising as advanced therapies and AI adoption face major efficiency hurdles.

- Societal & Environmental Challenges: Sustainability demands, public mistrust, and demographic shifts challenge pharma’s reputation and resource planning.

- Geopolitical & Economic Challenges: Supply chain risks, inflation, talent shortages, and currency volatility disrupt pharma operations globally.

- Technological & Operational Challenges: Cyber threats, complex manufacturing, and digital disruptors complicate pharma’s development and commercialization efforts.

Each of these pharmaceutical market trends are multi-faceted, and the pressures they introduce are deeply interconnected.

CI Prioritization of Pharma Trends and Headwinds

To help CI leaders focus efforts where they can deliver the greatest strategic value, Sedulo evaluated the market headwinds based on two dimensions from the questions above:

- Lower Priority Zone: Lower overall impact and limited CI influence; least urgent in terms of resource allocation

- Strategic Awareness Zone: High impact but limited CI influence; areas important to monitor but with fewer actionable levers for CI

- CI Actionable Zone: Moderate-to-low organizational impact but high CI influence; tactical or proactive intelligence opportunities

- Critical Zone: High organizational impact and significant CI influence; key priorities for CI professionals

Pharma Competitive Intelligence Prioritization Framework

From Pharma Market Trend Surveillance to Strategy: Rethinking CI’s Role

Pharma competitive intelligence is uniquely positioned to equip decision-makers with the foresight, context, and insight required to navigate these market trends and headwinds with confidence. By aligning intelligence efforts with the organization’s most urgent challenges and highest-impact opportunities, CI teams can shift from passive data gathering to active pharma strategy enablement.

The following breakdown outlines how CI can contribute across the three priority zones.

Strategic Awareness Zone

Key Trends to Consider

- Pharma Market Trend: Only 7.9% of drug candidates make it through clinical trials to successful approval, with R&D costs now exceeding $2.6 billion per drug 1

- Pharma Market Trend: AI is accelerating drug discovery, reducing timelines from 5–6 years to 1, and cutting trial costs by 70%, but integration is slow 2

- Pharma Market Trend: Cyberattacks are growing, with the average cost of a data breach growing 10% in 2024, and the impact to pharma 5% above the all-industry average 3

- Pharma Market Trend: Public confidence is low, only 44% of the public trusts the pharmaceutical industry 4

Some pharma industry challenges carry significant strategic risk but fall outside the direct control of competitive intelligence teams. In these cases, CI plays a critical role in building enterprise awareness, monitoring competitor responses, and supporting informed decision-making.

How CI Can Support

Lower R&D Productivity and Rising Costs

- Benchmark competitor R&D efficiency, pipeline attrition rates, and partnership strategies

- Lead scenario planning to identify acquisition targets or pipeline augmentation opportunities

Digitization, AI Integration, and Data Management

- Map AI-focused partnerships and investments across competitors

- Analyze how leading firms are structuring digital transformation roadmaps

Cybersecurity Threats

- Monitor threats targeting clinical operations and IP

- Benchmark competitor cybersecurity protocols and mitigation strategies

Public Trust and Reputation Management

- Track sentiment trends and stakeholder perception across regions

- Benchmark public trust campaigns and support crisis planning through competitor analysis

Pharma competitive intelligence enables organizations to stay informed and responsive in areas where direct influence may be limited but strategic awareness is essential.

Competitive Intelligence Actionable Zone

Key Trends to Consider

- Pharma Market Trend: Emerging market expansion: Between 2016 and 2021, pharma growth in Brazil (11.7%), India (11.8%), and China (6.7%) outpaced the United States (5.6%) 5

- Pharma Market Trend: Payer consolidation: By 2018, four national payers covered 85% of the US market, up from 74% in 2006 6

- Pharma Market Trend: Trial delays are costly: Each month of delay can result in $600,000 to $8 million in lost revenue depending on the therapy area 7

- Pharma Market Trend: RWE adoption is accelerating: In 2020, 90% of new drug approvals by the FDA included real-world evidence (Christina A. Purpura et al., “The role of real-world evidence in FDA-approved new drug and biologics license applications,” Clinical Pharmacology & Therapeutics).

This zone includes headwinds that may not be the most urgent at the enterprise level but represent clear opportunities for pharma competitive intelligence teams to deliver value. These areas are especially suited for proactive intelligence that supports strategic planning, executional alignment, and tactical differentiation.

How CI Can Support

Emerging Markets Competition

- Conduct deep-dive intelligence on local competitor activities in China, India, and Brazil

- Deliver foresight reports and benchmarks on innovation trends, commercial models, and regulatory shifts

Consolidation and Market Access Challenges

- Track payer and provider consolidation across major markets

- Benchmark market access strategies, reimbursement frameworks, and contracting approaches used by key competitors

Trial Recruitment and Diversity

- Analyze and compare strategies used by leading firms to recruit diverse and representative trial populations

- Provide insights into global site performance, enrollment timelines, and evolving regulatory expectations

Real-World Evidence and Data Transparency

- Evaluate how competitors are integrating RWE into regulatory filings and payer communications

- Identify opportunities for the organization to differentiate based on evidence generation, transparency, and value demonstration

This zone represents a high-leverage opportunity for pharma competitive intelligence teams. While these headwinds may not dominate C-suite discussions, they offer tangible pathways for CI to guide pharma strategy, improve planning, and deliver business-critical insights on market trends.

Critical Zone

Key Trends to Consider

- Pharma Market Trend: The Inflation Reduction Act (IRA) has introduced aggressive drug pricing negotiations, with the first round of selected therapies facing price cuts between 38% and 79%, effective in 2026 8

- Pharma Market Trend: Global compliance costs for major pharmaceutical companies have surpassed $50 billion annually, and are projected to grow over 7% annually 9

- Pharma Market Trend: Innovative pricing models are demonstrating patient/payer cost savings, signaling a shift toward outcomes-driven market access 10

- Pharma Market Trend: Manufacturing costs for cell and gene therapies remain prohibitively high, necessitating drastic efficiency gains to prevent rationing 11

- Pharma Market Trend: Regulatory divergence post-Brexit has forced companies to file separate EMA and MHRA applications, increasing cost, complexity, and potential delays 12

The Critical Zone encompasses pharma industry headwinds that pose the most significant strategic risks to life sciences organizations, challenges that directly affect revenue, access, and long-term competitiveness. Unlike broader macro trends, these are areas where pharma competitive intelligence teams can actively shape outcomes through focused intelligence, foresight, and decision support.

How CI Can Support

Patent Cliff and Loss of Exclusivity

- Identify competitive threats through proactive pipeline intelligence

- Support lifecycle extension strategies including formulation shifts, indication expansions, and combination therapies

Reimbursement Constraints and Pricing Pressure

- Benchmark global pricing and reimbursement strategies across key markets

- Provide predictive insights into payer behaviors and upcoming policy changes (e.g., US Medicare negotiations, EU HTAs)

Generic and Biosimilar Competition

- Monitor biosimilar approval timelines, entry strategies, and pricing shifts through dedicated dashboards

- Lead scenario-planning workshops to assess competitive moves following loss of exclusivity

Value-Based and Outcomes-Focused Models

- Track competitor agreements with payers and digital health partners

- Benchmark patient-centric approaches and digital companion strategies

Regulatory and Supply Chain Pressures

- Analyze evolving EMA and FDA guidelines and assess competitor responses to new compliance requirements

- Build early-warning frameworks for geopolitical disruptions and map API sourcing strategies

Advanced Therapies and New Entrants

- Deliver intelligence on cell and gene therapy pricing, market access, and timelines

- Monitor disruptive plays from non-traditional competitors such as Amazon and Google entering healthcare

This is where CI becomes a force multiplier, empowering organizations to defend core revenue, accelerate innovation, and adapt decisively to systemic change.

In Closing

Facing today’s headwinds demands more than awareness of pharma market trends, it requires actionable insights powered by rigorous intelligence.

At Sedulo Group, we help life sciences organizations go beyond surface-level tracking by delivering:

- Best-in-class primary research: direct insights from hard-to-access sources across clinical, commercial, and regulatory domains

- Comprehensive secondary research: synthesized market, policy, and competitor intelligence grounded in deep expertise

- Strategic frameworks: to turn intelligence into insight and insight into impact

Our CI Prioritization Framework is just one example of how we empower competitive intelligence and strategy teams to align intelligence efforts with what matters most.

The result? CI that informs pharma strategy, enables foresight, and drives smarter decisions.

Ready to elevate your competitive intelligence function? Contact Sedulo Group to learn how we can support your team’s evolving needs.